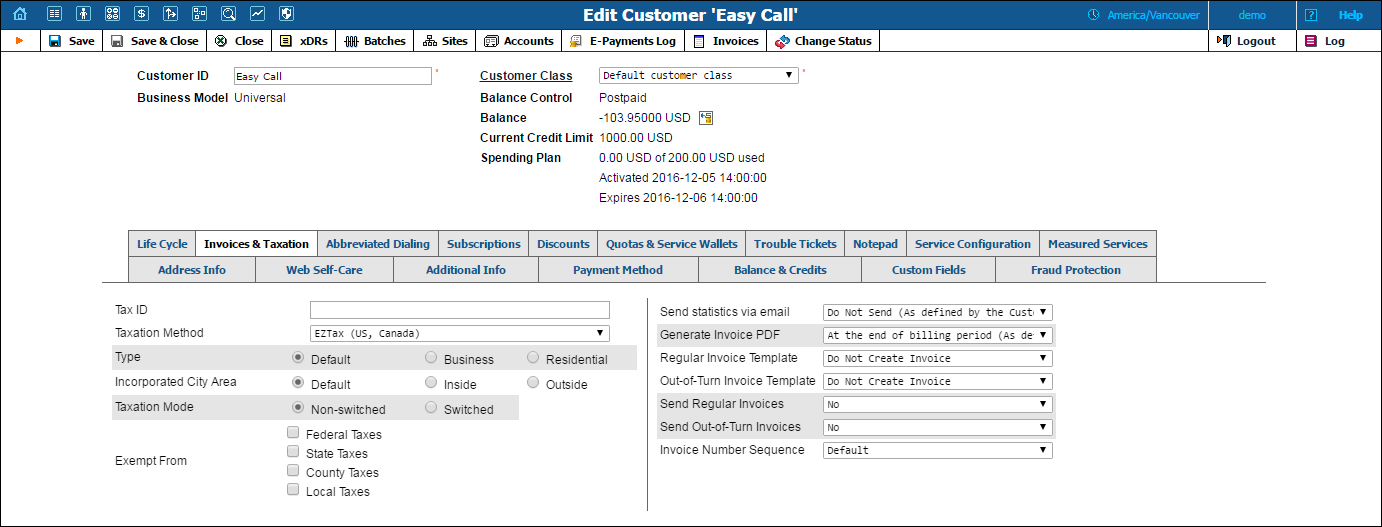

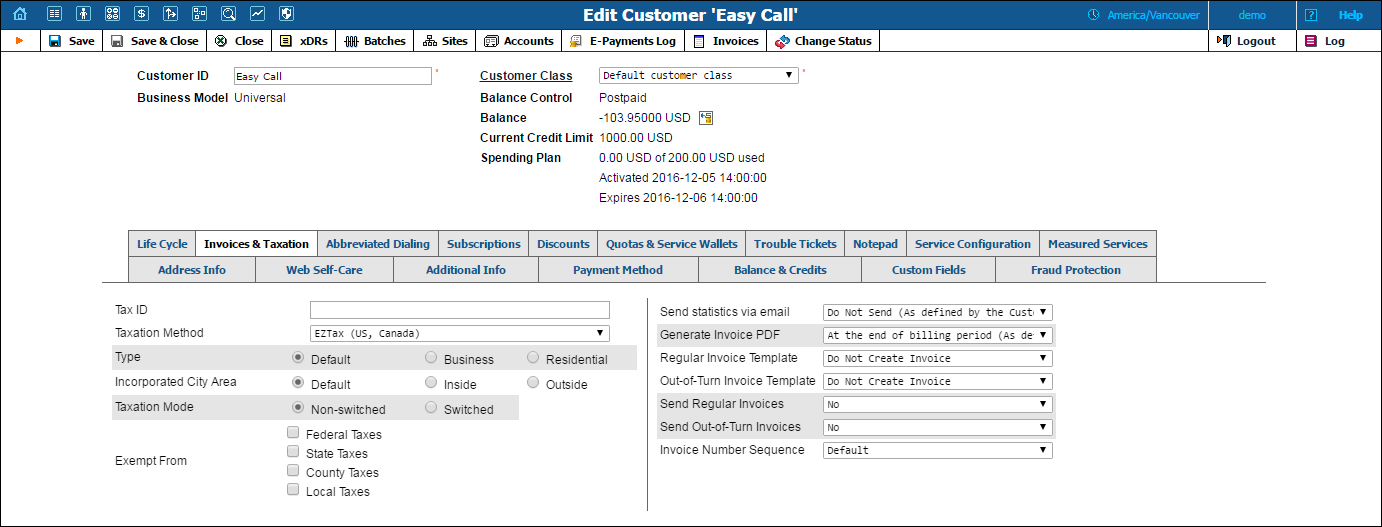

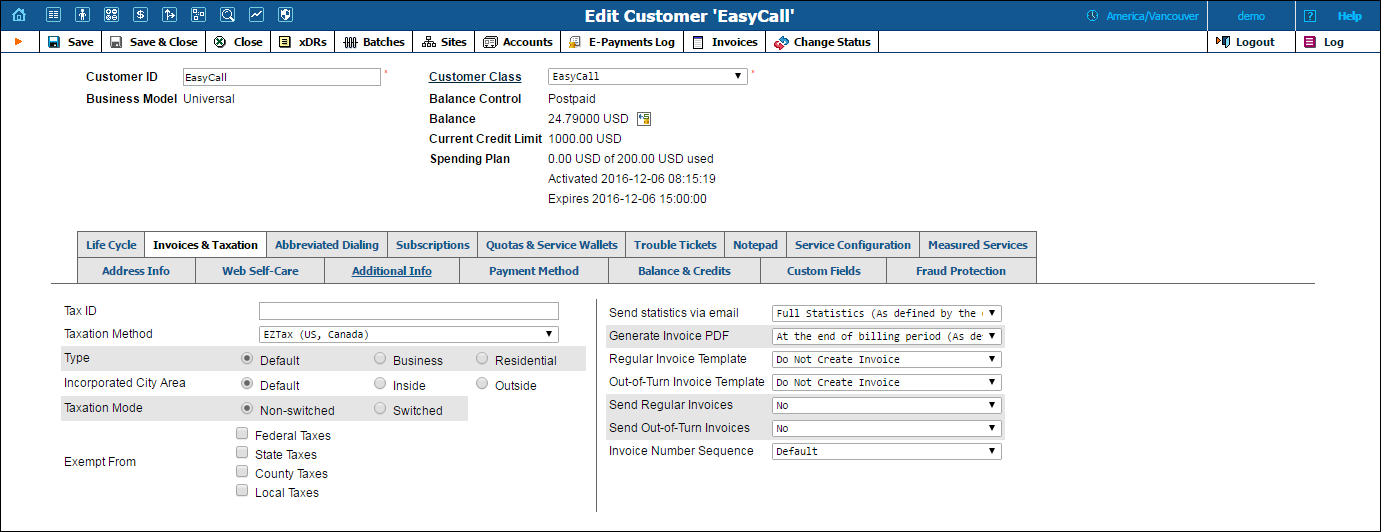

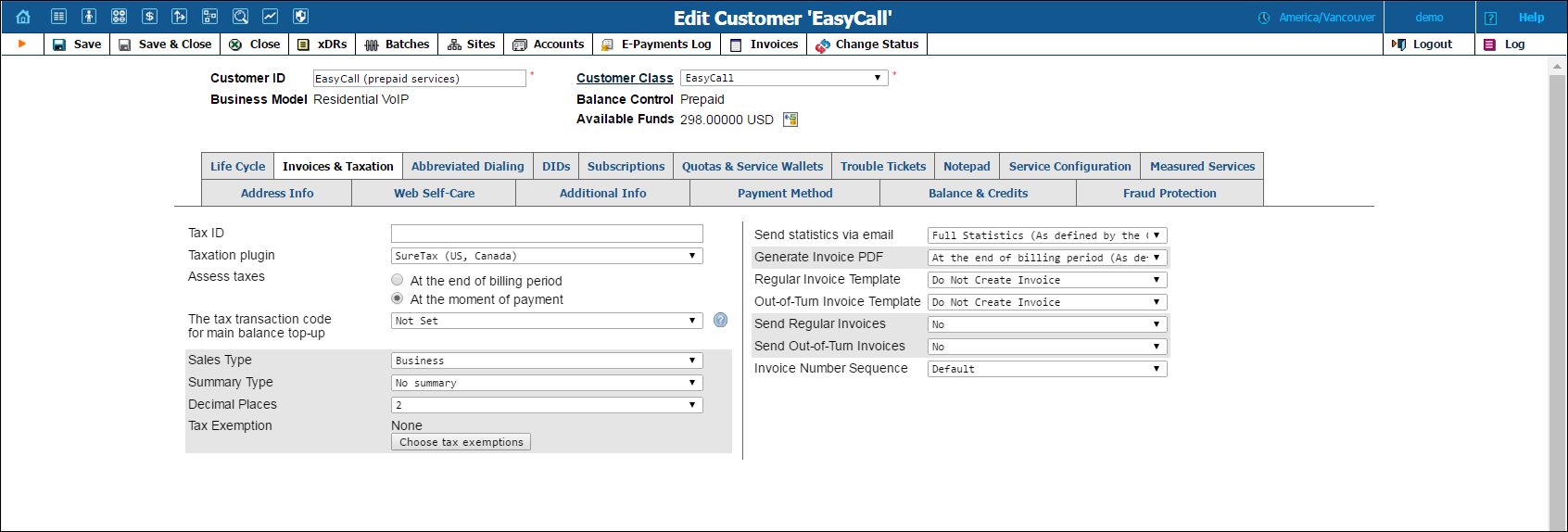

On the Invoices & Taxation tab you can define the following:

How to tax the distributor for provided services.

Whether to send statistics and invoices by email.

What invoice template to use and how to enumerate the invoices.

| Field | Description |

|---|---|

Tax ID |

Customer’s tax ID. |

Taxation Method |

|

Send Statistics via email |

Defines what kind of xDR statistics should be delivered to the customer by email after the billing period is closed:

Note that these options only affect the delivery of xDR files by email. The actual statistics files will always be generated and accessible for download from the administrator interface or customer self-care interface. |

Generate Invoice PDF |

|

Regular Invoice Template |

Defines the regular invoice template for this customer.

See the Templates page for more information. |

Out-of-Turn Invoice Template |

Defines the out-of-turn invoice template for this customer.

|

Send Regular Invoices |

Defines whether new regular invoices should be delivered to the customer by email.

See the Templates section for more information |

Send Out-of-Turn Invoices |

Defines whether out-of-turn invoices should be delivered to the customer by email.

|

Invoice Number Sequence |

Select an invoice number sequence that will be used for this customer:

|

Other option on this tab depend on the selected tax method and are described in the following subsections.

| Field | Description |

|---|---|

Customer Type |

Define the customer type of customers who use the services you provide. Select one of the following options:

|

Incorporated City Area |

Define the customer location:

|

Taxation Mode |

Specify which additional taxes will be calculated for a customer. The objects that are taxed depend both on the Taxation Mode and on the VoIP Taxation configuration.

Select one of the following options:

|

Lifeline Program |

Select whether a customer is entitled to a Lifeline assistance program. |

Exempt From |

Select which taxes this customer is exempt from. |

| Field | Description |

|---|---|

Type |

This field is used to specify the type of customer involved in the transaction:

|

Incorporated City Area |

This is used to specify whether a customer is inside or outside of an incorporated area that is designated as their location.

NOTE: Inner city tax jurisdictions are often based on postal code groupings. EZtax offers a service to define the correct US Post Office postal code using the customer's entire address. |

Taxation Mode |

This defines the taxation mode that helps apply relevant taxes for wide scale service.

|

Exempt From |

This designates which jurisdictional level of taxes are not applied to the customer:

|

Field |

Description |

|---|---|

Sales Type |

This field is used to specify the type of customer involved in the transaction:

|

Summary Type |

|

Decimal Digits |

Define number of decimal digits for rounding the taxes. |

Tax Exemption |

Click the Choose tax exemption button and in the dialog box select particular service categories to relieve a customer from taxes related to them. |

| Field | Description |

|---|---|

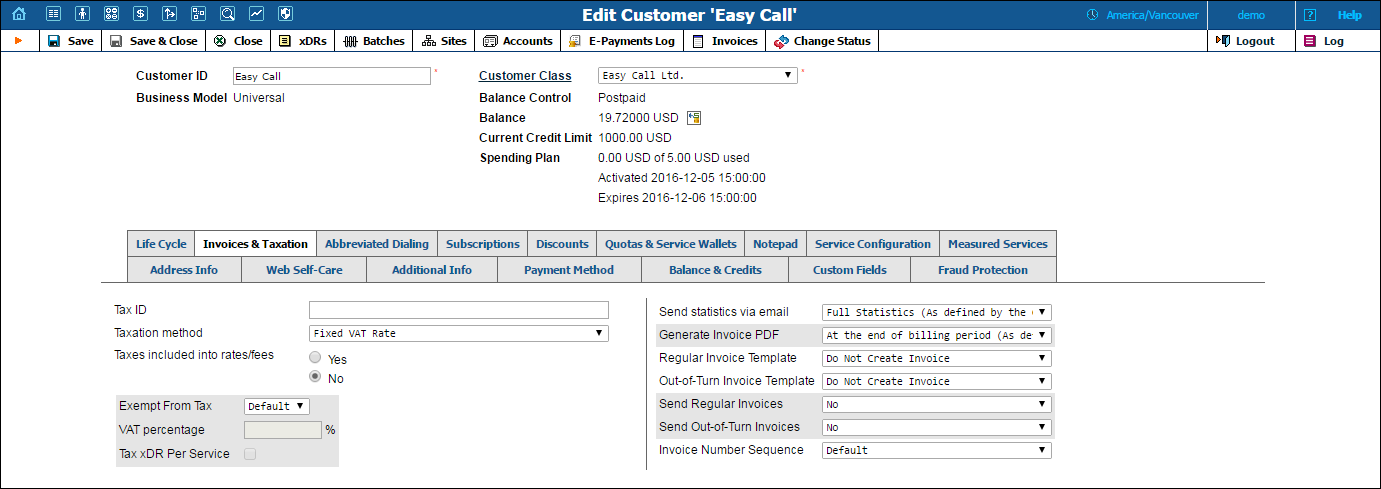

Taxes included into rates / fees |

Select whether taxes are included in the rates so they are calculated correctly:

|

Assess taxes |

Select when to apply taxes to customers:

For postpaid customers, taxes are calculated at the end of the billing period during statistics calculation based on the tax rate and the amount of payment / charge.

|

Exempt From Tax |

This defines whether customer is relieved from taxes:

|

VAT percentage |

Specify a certain percentage of value-added tax. |

Tax xDR Per Service |

This allows you to calculate taxes per service (and respectively show them on invoices).

This option is applicable if you do not include taxes in your rates. |

| Field | Description |

|---|---|

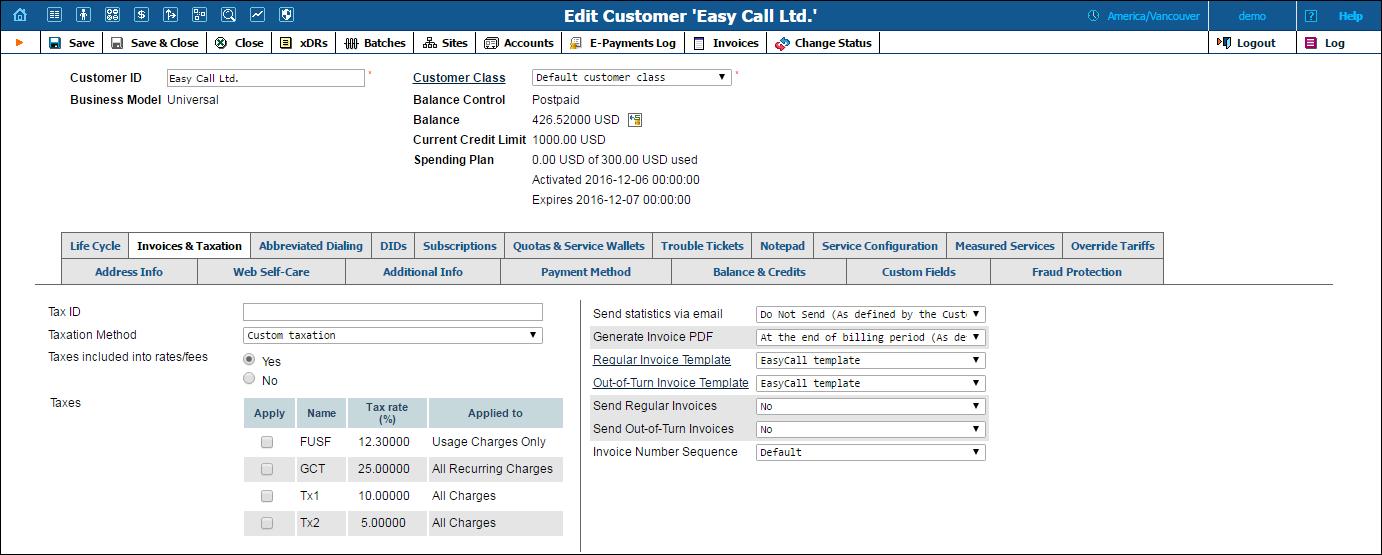

Taxes included into rates / fees |

Select whether taxes are included in the rates so they are calculated correctly:

|

Taxes |

This displays the list of custom taxes. If no taxes are defined, click the Define Custom Taxes here link. See the Custom Taxation page for how to define taxes. |

Apply |

Select the check box to apply the tax listed in this row. NOTE: You can adjust custom tax rates on the Taxation page of the main menu. |

Name |

The descriptive name of the tax in the system (will be present in xDRs and in taxation configuration). |

Tax rate (%) |

A percentage value for this tax. |

Applied to |

This field shows which services this tax is applied to. Here select one of the available options:

|

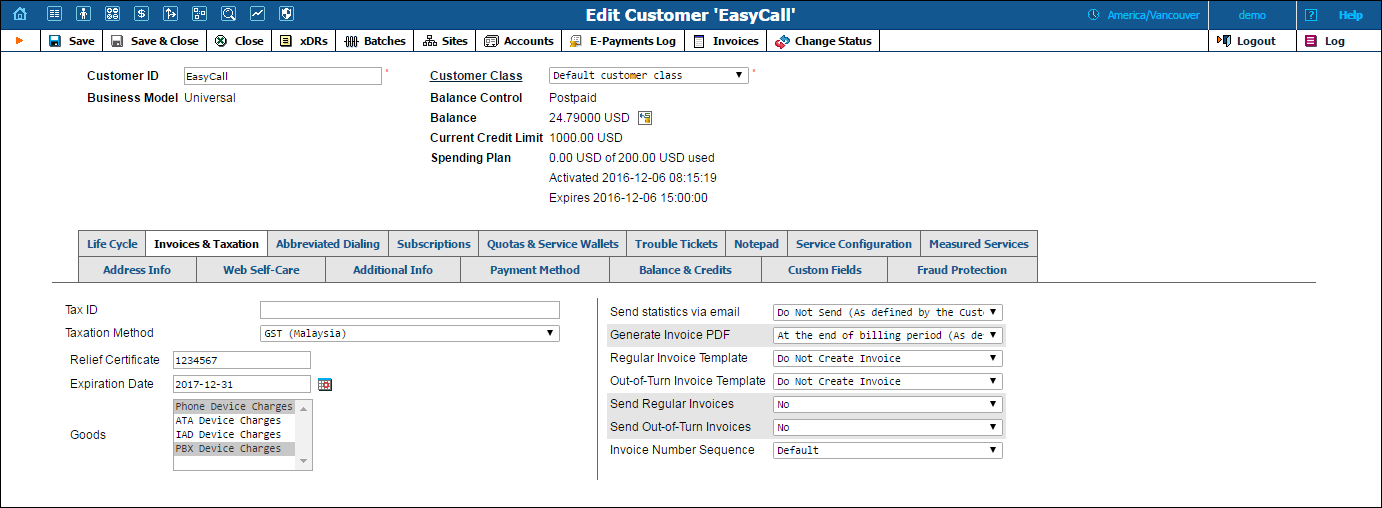

| Field | Description |

|---|---|

Relief Certificate |

By default, the GST plug-in applies a 6% goods and services tax. If you have a relief certificate code that applies 0% tax for goods, specify the code in this field. |

Expiration Date |

Indicate when the relief certificate expires. |

Goods |

Select the goods that fall under the relief certificate with 0% tax. |