You are viewing a document related to an older software Maintenance Release%XX%. Click here to see the latest version of PortaSwitch

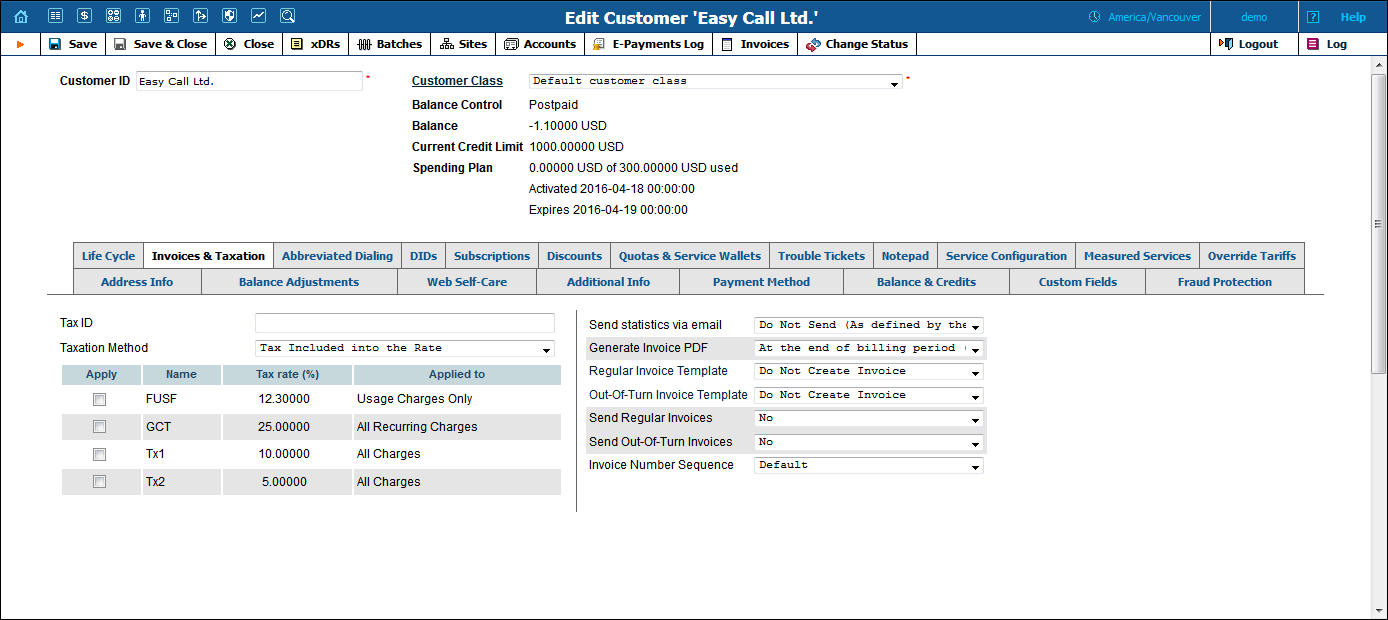

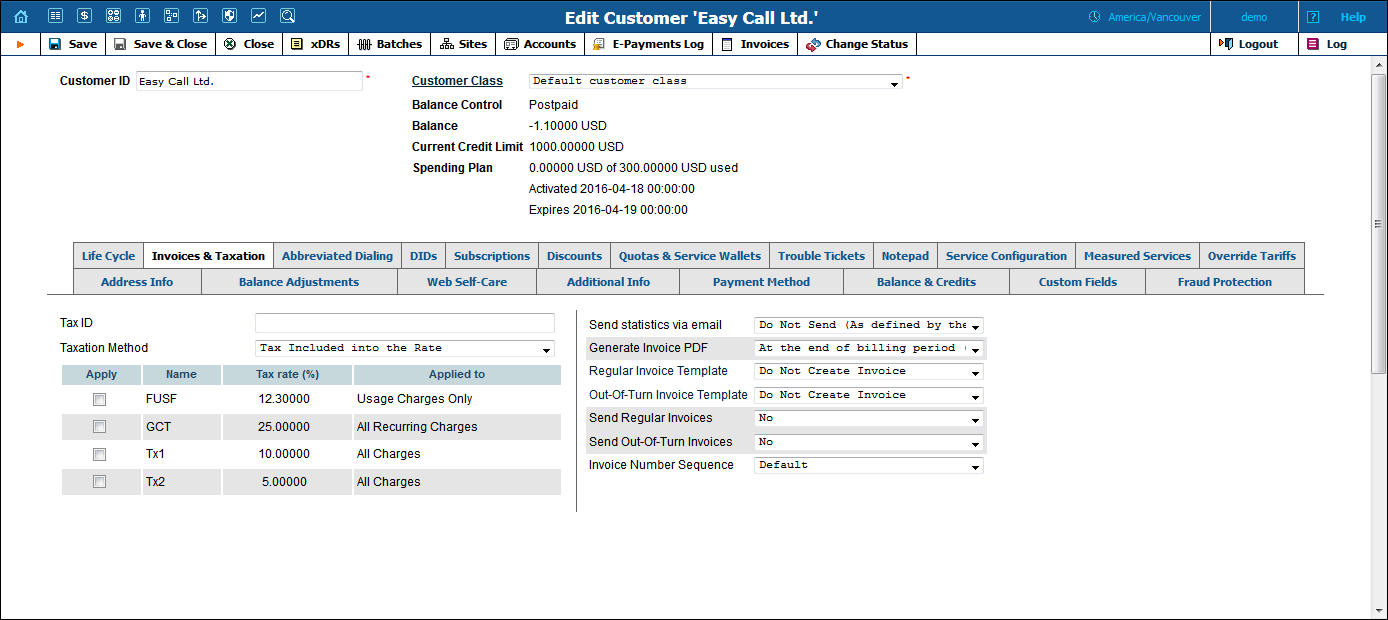

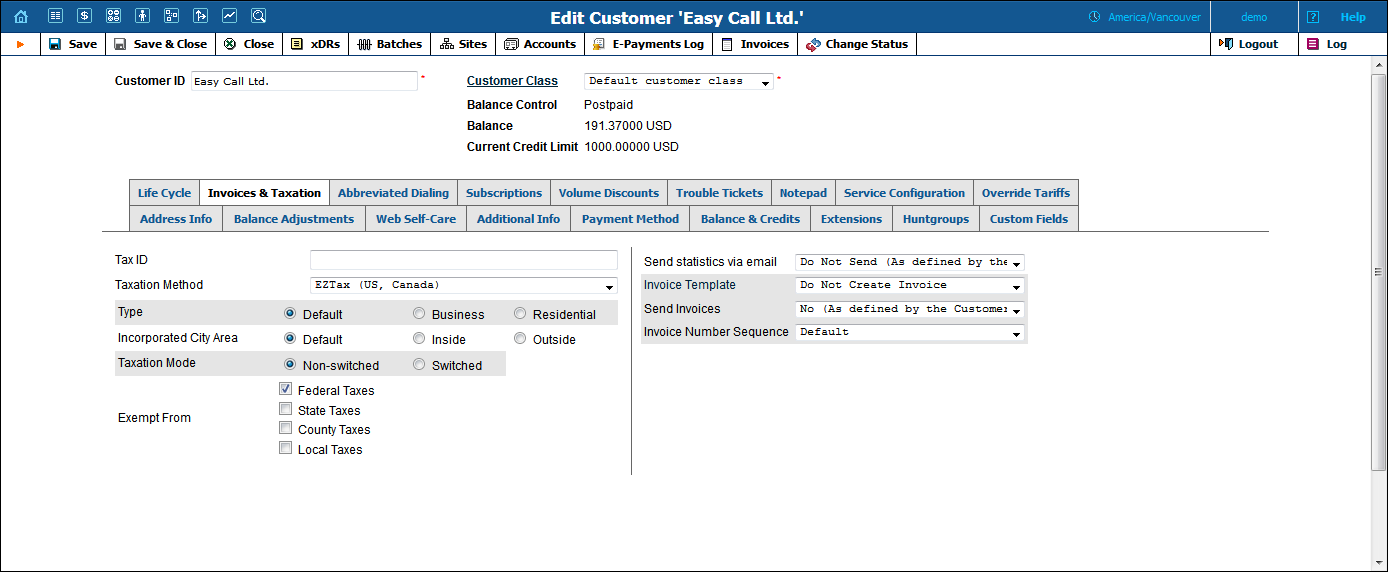

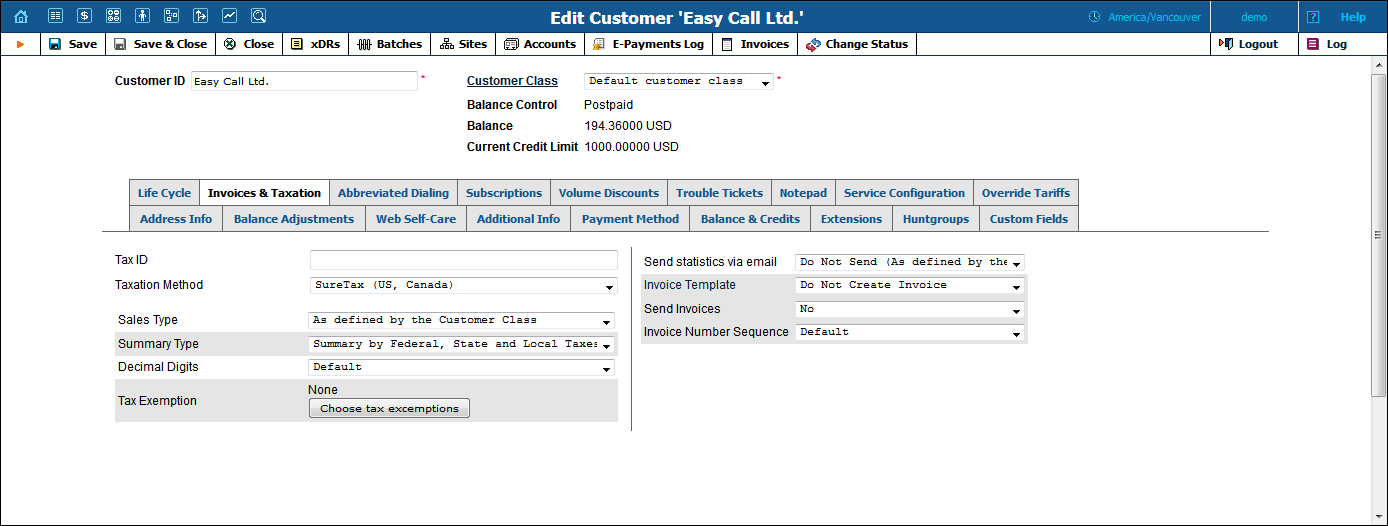

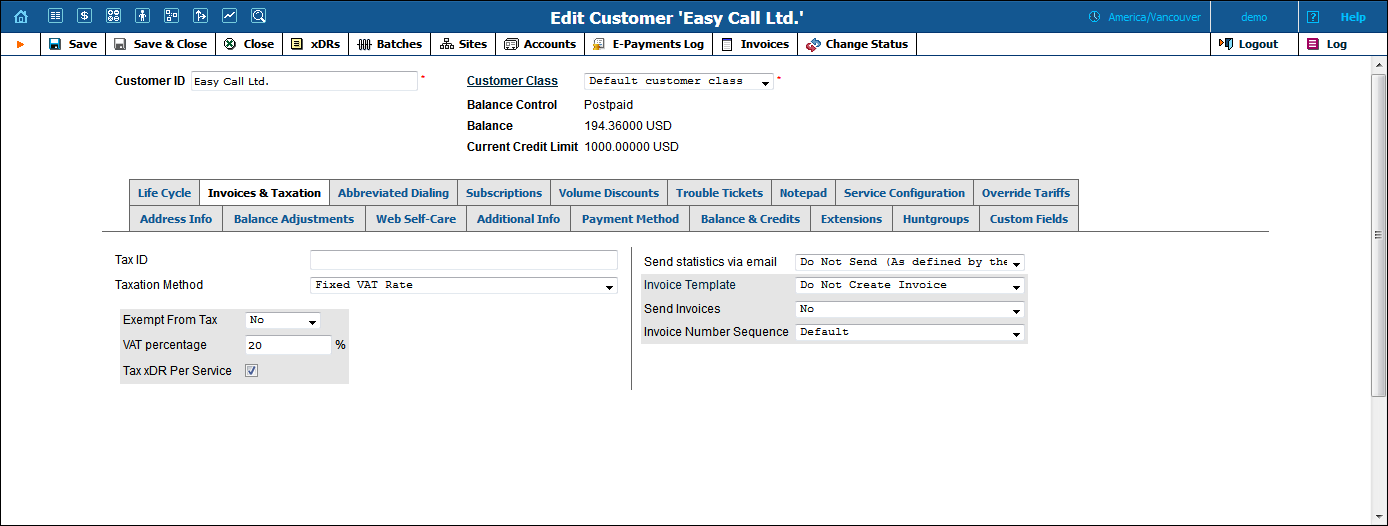

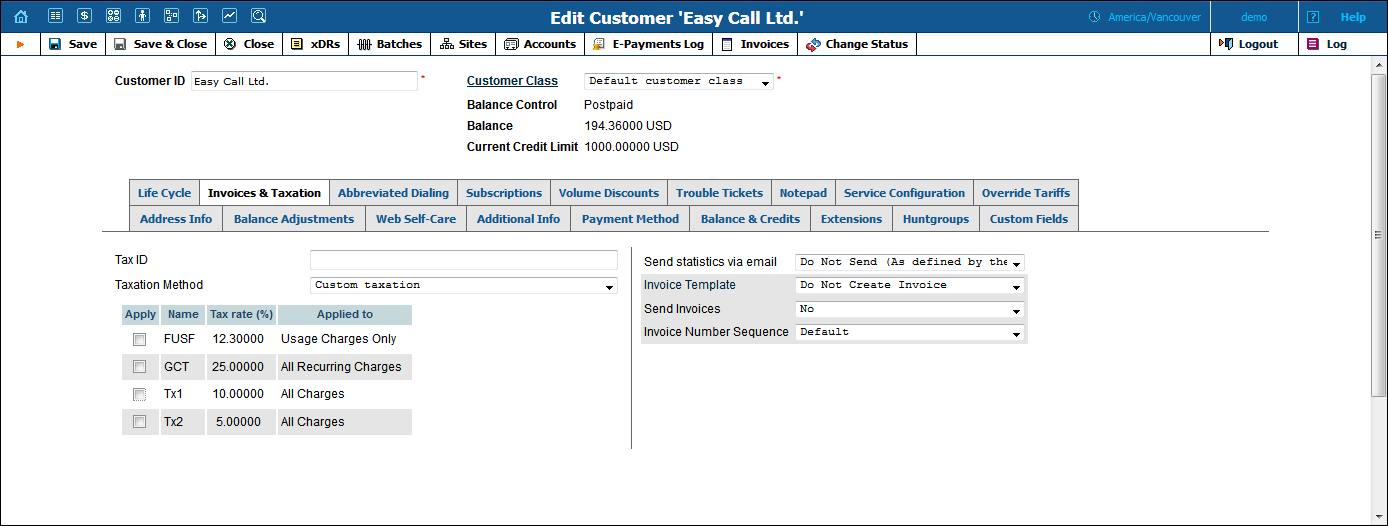

On the Invoices & Taxation tab you can define the following:

How to tax the customer for provided services.

Whether to send statistics and invoices by email.

What invoice template to use and how to enumerate the invoices.

| Field | Description |

|---|---|

Tax ID |

Customer’s tax ID. |

Taxation Method |

NOTE: If you defined the invoicing and taxation configuration via a customer class and then override a taxation plugin for an individual customer, PortaBilling® clears the Regular invoice and Out of turn invoice template settings to avoid configuration mismatches. For example, when you change a taxation plug-in from SureTax to Fixed VAT Rate for a customer, the Regular invoice template value changes from As defined by the Customer Class to Do Not Create Invoice. To resume invoice generation, assign the invoice template that is compatible with new taxation plugin to the customer. |

Send Statistics via email |

Defines what kind of xDR statistics should be delivered to the customer by email after the billing period is closed:

Note that these options only affect the delivery of xDR files by email. The actual statistics files will always be generated and accessible for download from the administrator interface or customer self-care interface. |

Generate Invoice PDF |

|

Regular Invoice Template |

Defines the regular invoice template for this customer.

See the Templates section for more information. |

Out-of-Turn Invoice Template |

Defines the out-of-turn invoice template for this customer.

|

Send Regular Invoices |

Defines whether new regular invoices should be delivered to the customer by email.

See the Templates section for more information |

Send Out-of-Turn Invoices |

Defines whether out-of-turn invoices should be delivered to the customer by email.

|

Invoice Number Sequence |

Select an invoice number sequence that will be used for this customer:

|

Other option on this tab depend on the selected tax method and are described in the following subsections.

| Field | Description |

|---|---|

Type |

This field is used to specify the type of customer involved in the transaction:

|

Incorporated City Area |

This is used to specify whether a customer is inside or outside of an incorporated area that is designated as their location.

NOTE: Inner city tax jurisdictions are often based on postal code groupings. EZtax offers a service to define the correct US Post Office postal code using the customer's entire address. |

Taxation Mode |

This defines the taxation mode that helps apply relevant taxes for wide scale service.

|

Exempt From |

This designates which jurisdictional level of taxes are not applied to the customer:

|

Field |

Description |

|---|---|

Sales Type |

This field is used to specify the type of customer involved in the transaction:

|

Summary Type |

|

Decimal Digits |

Define number of decimal digits for rounding the taxes. |

Tax Exemption |

Click the Choose tax exemption button and in the dialog box select particular service categories to relieve a customer from taxes related to them. |

| Field | Description |

|---|---|

Apply taxes at the moment of payment (for prepaid customers and debit account only) |

With this option selected, the taxes for services will be calculated and applied to prepaid customers based on the tax rate and the top up amount. The total sum of payment will be increased by the calculated tax amount (e.g. a user enters a $10 payment to top up the balance. The system calculates the taxes and adds them to the entered amount, increasing the sum total. The user is provided with full payment information: the entered amount, the tax amount and the sum total.) Upon payment processing, the customer’s balance is increased by the actual amount ($10), excluding taxes. |

Exempt From Tax |

This defines whether customer is relieved from taxes:

|

VAT percentage |

Specify a certain percentage of value-added tax. |

Tax xDR Per Service |

Select this check box to produce tax xDRs for each service separately. |

| Field | Description |

|---|---|

Apply taxes at the moment of payment (for prepaid customers and debit account only) |

With this option selected, the taxes for services will be calculated and applied to prepaid customers based on the tax rate and the top up amount. The total sum of payment will be increased by the calculated tax amount (e.g. a user enters a $10 payment to top up the balance. The system calculates the taxes and adds them to the entered amount, increasing the sum total. The user is provided with full payment information: the entered amount, the tax amount and the sum total.) Upon payment processing, the customer’s balance is increased by the actual amount ($10), excluding taxes. |

Apply |

Select the check box to apply the tax listed in this row. NOTE: You can adjust custom tax rates on the Custom taxation page of the main menu. |

Name |

The descriptive name of the tax in the system (will be present in xDRs and in taxation configuration). |

Tax rate (%) |

A percentage value for this tax. |

Applied to |

This field shows which services this tax is applied to. Here select one of the available options:

|

| Field | Description |

|---|---|

Relief Certificate |

By default, the GST plug-in applies a 6% goods and services tax. If you have a relief certificate code that applies 0% tax for goods, specify the code in this field. |

Expiration Date |

Indicate when the relief certificate expires. |

Goods |

Select the goods that fall under the relief certificate with 0% tax. |